Battery Technology for Data Centers: An in-depth analysis of lead and lithium technologies

January 2022

Authored By:

Curtis Ashton, Director of Training, American Power Systems

Thomas Flores, Technical Sales and Product Management, East Penn Manufacturing

Introduction

Without question, the critical service that data centers provide requires an uninterruptable power supply (UPS) that is backed by a reliable, proven power source. Almost as important: The power source must minimize total cost of ownership (TCO) in order to be sustainable. Experienced data center operators need a battery technology that is a proven and powerful solution. These same operators also value other TCO critical factors such as recyclability, safety, and cost. There are promising developments for both lithium and lead battery technologies in data center applications. While lithium offers benefits such as higher energy density, less floor space, and reduced overall system weight, lead technology is a proven, safe, and sustainable solution. Decision makers should study all aspects of their power solution before becoming an early adopter of emerging lithium technology. This white paper provides a comparison of lead battery and lithium battery facts that directly impact the overall TCO, and valuable insight so the most informed, cost-effective, secure and sustainable choice can be made.

Safety Profiles Are Critical

LEAD BATTERIES: Non-combustible

Experienced data center operators know lead batteries are an extremely safe and established technology. Technicians and customers are very familiar with them from decades of experience in maintenance, possible failure modes and safety measures. Some of the most important safety features of current lead batteries are safety valves, a sealed design, and an electrolyte that is water based and most importantly non-combustible. In the rare occurrence that a lead battery fails or would be accidentally exposed to an open flame, it will not become a fire hazard. Based on these features, lead battery technology is generally not subject to the same fire code restrictions as lithium batteries, which reduces space, costs and overall risk to data centers.

Page 1

LITHIUM BATTERIES:

Fire-hazard Restrictions

Lithium batteries are currently made with a flammable electrolyte, which in the case of failure is prone to high temperatures, combustion, and catastrophic damages. Safety and firefighting standards are still being developed through various safety organizations. A recent disaster in Illinois highlights this in detail. Approximately 100 tons of warehoused lithium batteries caught fire, causing the evacuation of 5,000 residents, and the governor to declare a disaster proclamation. The fire burned for several days with several methods of extinguishing attempted.1 However the only proven way of eliminating a lithium battery fire is copious amounts of water for a long time, with a continued fire watch to ensure water can be reapplied if reignition occurs. In addition to safety standards, lithium batteries are subject to more restrictive rules in the Fire Codes (IFC, NFPA 1, and NFPA 855). Floor restrictions are a major component of these Fire Code Standards. A data center powered by lithium batteries must not be located on a floor level that cannot be reached by a ladder truck, and also are not allowed in the basements of buildings. Both factors are especially relevant for data centers in large urban areas such as New York City, the financial center of the world markets. Spacing requirements are another critical component of the standard. Specifically, three-foot spacing is required on all sides of the lithium battery, including between each individual system. Spacing is also required between systems and walls, ceilings, or any other element that could be flammable. That extra spacing requires more floor space and subsequent cost (see TCO section).

Lifespan Needs To Be Proven

The service life of lead batteries in critical power applications is proven. Lead batteries, including advanced lead batteries such as the Deka Fahrenheit, offer a successful track record of performance and life, with years of field data to support results. Competing battery technologies often misrepresent lifespan comparison by only making comparisons to traditional VRLA batteries, rather than advanced lead batteries with a longer service life. Lithium batteries have not been in market applications long enough to determine actual service life. There are many claims of lithium battery life of 10 or 15 years, but that remains unproven by actual field data. Also, lithium battery projections are usually based on early data points, which do not equal real-world, end-of-life results.

Reliable Supply Chain and Material Sourcing

Data centers must be immune to downtime and data loss. They rely on backup energy storage providers to meet their infrastructure needs on time and budget. But today’s high-stakes, volatile geopolitical situation (compounded by a pandemic) is causing supply chain instability and limiting product availability for both manufacturers and end users.

Page 2

LEAD BATTERIES: Reliable, Domestic Supply

For lead batteries that traditionally require virgin lead in applications such as data centers and telecommunications, lead originates from stable countries such as South Korea, Canada, India, Belgium, and Australia.2 Recently, there are also advances in lead technology to refine secondary lead (recycled) and lead alloys to very high levels of purity, producing product performance similar to pure virgin lead. This improvement will provide an even greater abundance of sustainable and recycled lead.

FIG 1 – Lead Battery Recycling

Lead batteries are the most sustainable battery technology today. They have an established recycling network in North America that creates a circular manufacturing loop. It supplies a steady stream of raw materials from a recycled lead battery’s componentry including lead (which is infinitely recyclable), electrolyte, and plastics to U.S. battery manufacturers. This circularity ensures production goals are met and material costs stay low.

Page 3

LITHIUM BATTERIES: Reliant on Imports

In contrast, the lithium battery supply chain is far more unpredictable and more reliant on a single source for materials and production. Applications are also a critical consideration — electric vehicles are the largest segment of lithium-ion powered vehicles. As the demand for electric vehicles continue to skyrocket, the challenge lies in scaling up lithium production to meet that need. It’s important to weigh how that demand challenge affects availability of product for other applications such as data centers. Based on a recent Wall Street Journal article, 75% of the world’s lithium batteries are made in China.(3) One country having majority control over products and raw materials can greatly influence financial markets such as global commodity supply and pricing. An example of this is NMC lithium batteries, which contain nickel, manganese, and cobalt – with varying ratios of the three materials in the final product.(4)

• Manganese – China produces more than 90% of the world’s manganese products. Since October 2020, dozens of Chinese manganese processors accounting for most of global capacity have joined a state-backed campaign to establish a “manganese innovation alliance.” They include centralizing control over supply of key products, coordinating prices, stockpiling, and networks for mutual financial assistance.(3)

• Nickel – Even if a majority of raw material isn’t supplied by a single country, pricing models can be impacted. In March 2021, after an announcement by China related to nickel production, the daily price of nickel plummeted 9% in one day.(3)

• Cobalt – The largest exporter of cobalt is the Democratic Republic of Congo, which is known for its struggles with conflict minerals. While not officially classified as a conflict mineral, cobalt has faced scrutiny in recent years from human rights violations identified in the mines where it is sourced. Child labor and hazardous working conditions have become associated with its production in the Democratic Republic of Congo where about two-thirds of global production occurs.(5) Specific to lithium, the original sources of lithium are Chile, Bolivia, and Argentina.

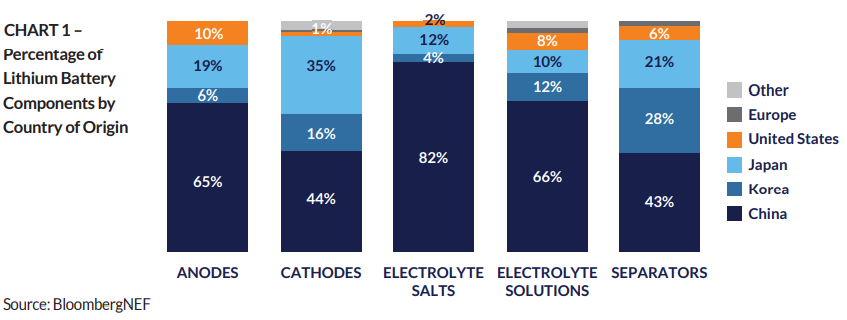

The reliance on imports can be either beneficial or detrimental to U.S. interest, depending on trade relationships. In addition to raw materials, lithium batteries require a coating process to apply active materials, conductive additive, and binder.(6) For lithium-ion battery manufacturers, U.S. producers are also heavily dependent on Asian suppliers for the packaging/coating process (see Chart 1).

Page 4

Environmental Impact

Environmental factors, especially sustainability, are fundamentally important in considering battery technology. Battery recycling success rates are driven by a number of factors, such as the battery’s complexity (the more componentry, the more difficult recycling is), whether an established network exists to collect and process used batteries, and the market value of the recycled material to create new products.

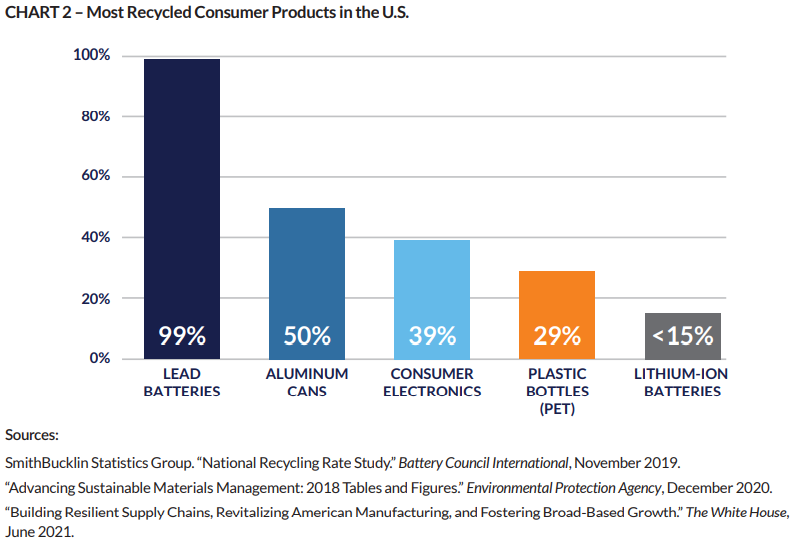

LEAD BATTERIES: 100% Recyclable

The recycling and sustainability of lead batteries is a success story. Virtually 100% of a lead battery’s three basic components – lead, plastic, and acid – are recyclable. Today, lead batteries are the most recycled consumer product with a recycling rate of 99%(7) (see Chart 2.) Not only are they recyclable, but also sustainable, meaning the components are of great value. It is economically profitable to recycle them for use in new batteries. That creates an incentive and a substantial financial credit for the customer. This is the pinnacle of a circular economy. In short, lead batteries never really die; they get remade.

In addition to being environmentally sustainable, there are also financial benefits to using lead battery technology including lower CAPEX expenditures and receiving a financial credit at end-of life (see TCO section for more detail).

Page 5

LITHIUM BATTERIES: 15% Recycled

Currently, the percentage of lithium batteries that are recycled is less than 15%.(8) To boost that number, the U.S. government is investing a great deal of resources to assist companies in finding solutions. Although several companies are exploring ways to meet this challenge, there remains no full-scale North American commercial operation that has shown success in recovering metals for reuse in new lithium batteries similar to the overall sustainability provided by lead battery technology. The complex design and mix of materials in a lithium battery compound the recycling challenge. Plus, there’s still a cost associated with the recovery of these metals versus the financial credit that lead delivers.

Further challenging the lithium battery industry is the multiple lithium chemistries in the marketplace. Batteries with a higher concentration of nickel and cobalt (NMC) are more valuable than a safer chemistry like lithium iron phosphate (LFP). Current commercial operations will either break down the cells using a water- or heat-based process. The result of these processes depends on the technology.

For NMC products, the process produces three basic materials: shredded copper and aluminum commonly referred to as stock-feed, mixed plastics, and a black mass. If the black mass contains adequate valuable metals, it results in a nickel-cobalt cake that can be sold to a refinery for further extraction. Specific to lithium iron phosphate (LFP) batteries, there currently is no value for the inert end materials, and it is sent to landfills. Should companies move away from nickel and cobalt due to sourcing issues, the value of the black mass decreases. If companies can commercially prove that lithium and other metals can be successfully extracted from this black mass as battery-grade high-purity metals, only then will they be reused in the building of new batteries – at a cost. It is valuable to note that lithium battery disposal/recycling is changing regularly as research is being completed and operations are scaled for commercial production. This will help the supply chain of these materials, but not create a financial value compared to lead.

Total Cost of Ownership (TCO), Including Replacement

TCO is one of the most important factors for data centers when selecting a battery system. A lead battery system offers a unique advantage: a financial credit when the batteries are returned for recycling.

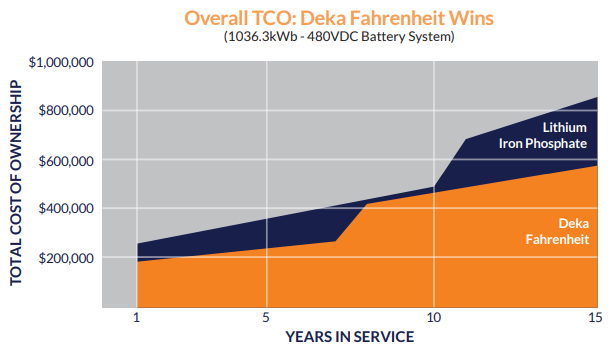

The effect on TCO is shown by comparing a 1MWh UPS system with a standard 20-year life expectancy and Deka Fahrenheit lead batteries. The latter offers savings both in lower initial capital investment and at the end-of-life. Based on a credit of $33/KWH, the Deka Fahrenheit lead battery UPS system provides a lifetime TCO savings of over $264,000 when compared to the lithium system.

Lithium systems also impose a dismantling cost. Based on a study by the Electric Power Research Institute (EPRI), the cost to disassemble a 1 MWh lithium-powered system is estimated at $91,500 ($91/kWh). This includes the cost of labor, transportation and lithium battery disposal. Furthermore, lithium batteries have certain restrictions for shipping. They can be shipped at 100% state-of-charge for ground transportation, but must be reduced to <30% state-of charge for air transport. Lead has no such requirement.

NOTE: The majority of white papers favoring lithium technology focus on the lead replacement and not lithium’s end-of-life costs, which should be carefully considered. Many in the market refer to repurposing the lithium product at end-of-life. This is speculation by lithium battery manufacturers. With the specific requirements and tolerances demanded by high-end equipment using batteries, used batteries with individual and unequal voltages may be unable to perform as needed and disposed at a cost (see Environmental Impact section).

Page 6

Warranted Life

The warranted life for lead and lithium batteries differ and is worthy of further detail analysis. Best-in-class lead batteries, such as the Deka Fahrenheit, are warranted at five years in a UPS application, while lithium batteries are warranted for 10 years.9 There are two potential flaws in this longer warranty claim, specifically, proven life and components.

In data center applications, lithium batteries have not had the proven field usage over a 10-year duration to statistically support those life claims. In addition, the other item to consider when examining the warranty of a lithium battery is the required battery management system (BMS). Lithium batteries require a BMS to monitor safety and performance. In addition to being another potential area for failure, this device is sometimes warranted less than the system. The device is typically dependent upon using the OEM that sold the batteries to update/upgrade the BMS as needed or risk voiding the warranty. Lead batteries do not require ancillary equipment to function correctly.

Higher-temperature Tolerance

Many white papers about lithium refer to the fact that lead battery life declines when operated higher than 77° F. However, they neglect to inform customers that lithium-ion chemistries used in UPS applications have similar life-shortening effects at higher temperatures. While this is accurate for standard lead batteries, it is an inaccurate comparison to advanced, heat-tolerant lead batteries, such as Deka Fahrenheit. It is designed to operate and provide long life at 95° F. In that way, the Deka Fahrenheit batteries do not require the use of costly cooling systems, reducing the facility’s overall energy cost and carbon footprint.

Service Provider Options

Whether lead or lithium, both systems will need routine maintenance over their lifetime. Data centers should consider how much freedom they want in selecting a maintenance company. Current original equipment manufacturer (OEM) cabinet manufacturers provide the entire UPS, including lithium batteries. This locks a data center into that single OEM for the duration of the UPS system, including replacement batteries that must be from the same OEM, as well as ongoing service and maintenance. Lead batteries offer more options. Data centers can choose from a variety of lead battery systems and service providers. This offers more control over capital and operating expenses.

Page 7

Supplier Longevity and Data Center Experience

While lithium battery technology is new and exciting, the future remains unclear. There are still many open questions and concerns that need to be addressed for their use in critical power applications. Data centers must also consider the longevity of their battery system supplier.

In today’s market, Deka Fahrenheit is proving to be the optimum choice for rapidly evolving data centers. Deka Fahrenheit batteries are built by East Penn Manufacturing, the world’s largest single-site lead battery manufacturer in the world. With more than 75 years in the battery business, the company has driven advances in technology and manufacturing, including lithium-ion in motive power and renewable applications. East Penn Manufacturing has over a quarter century of experience with Forbes 100 data center applications. Customers can trust the company to provide proven products well into the future.

Conclusion

Our data-driven world demands that data centers have around-the-clock UPS. Selecting a battery technology system requires data center managers to evaluate many key factors in the lead or lithium debate. While there have been promising developments in lithium and lead batteries, advanced lead batteries like Deka Fahrenheit are a reliable, proven, and safe choice with superior sustainability, all of which minimize total cost of ownership in critical data center applications.

Page 8

SOURCES:

- CBS2 Chicago Staff. “State Declares Disaster For Morris After Battery Fire.” CBS Chicago, 5 July 2021.

- “Lead Refined Unwrought.” The Observatory of Economic Complexity (OEC).

- Yap, Chuin-Wei. “China Hones Control Over Manganese, a Rising Star in Battery Metals.” The Wall Street Journal, 21 May 2021.

- “Targray NMC Powder for Battery Manufacturers.” Targray.com.

- Ndagano, Patricia. “No, cobalt is not a conflict mineral.” African Arguments, 5 May 2020.

- “The Four Components of a Li-ion Battery.” SamsungSDI.com.

- SmithBucklin Statistics Group. “National Recycling Rate Study.” Battery Council International, November 2019.

- Jacoby, Mitch. “It’s time to get serious about recycling lithium-ion batteries.” Chemical & Engineering News, 14 July 2019.

- “Vertiv™ HPL Lithium-Ion Battery Energy Storage System.” Vertiv.com.

White Paper: Battery Technology for Data Centers: An in-depth analysis of lead and lithium technologies